The Many Benefits of Going Solar

What Are the Financial Benefits?

When you put a solar energy system on your property, you save money on your electric bills while also protecting yourself against future increases in electricity costs. The amount of money you may save depends on utility rates and solar incentives in your region, but going solar is always a great option.

What Solar Energy Rebates Are Available?

Depending on where you reside, solar subsidies and incentives may differ. The most significant is the federal investment tax credit (ITC), which allows you to deduct 26% of the cost of your solar energy system from your taxes. Some states provide additional tax credits, and certain cities and utilities offer cash refunds or other benefits.

Will I Still Receive an Electric Bill?

If you have a solar energy system with battery storage, you will still get a bill from your utility even if you are completely off the grid. However, by installing a solar panel system that matches your consumption, you may significantly cut your cost or even pay nothing at all.

What Are the Environmental Benefits?

Solar power, like other renewable energy sources, has a number of environmental and health advantages. Going solar lowers greenhouse gas emissions while also lowering air pollution levels such as sulfur dioxide and particulate matter which may cause health issues.

What Size of Solar System Do I Need?

The size of your solar energy system will be based on how much electricity you consume each month, as well as the weather in your area. A Solar provider will be able to help you determine this by looking at your monthly electricity bill.

Will My Roof Qualify For Solar?

Solar panels are best installed on southerly-facing roofs with little to no shade and enough space to accommodate a solar panel system. If your home doesn't have the ideal solar roof, there are workarounds that can be discussed with your solar installer.

Solar Panels in 2022

Solar energy is an enticing concept for anyone wanting to save on their utility bills and do their part for the environment. Hundreds of thousands of homeowners across the US have switched to solar, and you can join them.

Perhaps the biggest reason you haven’t gone solar yet is because the upfront cost is too restrictive. But have you heard about the chance to get free solar panels in your state?

While truly free panels aren’t necessarily attainable, you can qualify for rebates, tax credits, and incentives to slash upfront costs to almost nothing. Then you can look into opportunities to keep operating costs down and shorten the payback period. Financing is also usually available.

What Solar Incentives Are Available?

Solar Investment Tax Credit (ITC)

The solar Investment Tax Credit (ITC) is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 10,000% - creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process. SEIA has successfully advocated for multiple extensions of this critical tax credit, including the most recent delay of the credit phasedown in December 2020.

Quick facts

The ITC is a 26 percent tax credit for solar systems on residential (under Section 25D) and commercial (under Section 48) properties. The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms.

The residential and commercial solar ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006, with an average annual growth of 50% over the last decade alone.

Eligibility for the Section 48 ITC is based on a “commence construction” standard. The IRS issued guidance in June 2018 that explains the requirements taxpayers must meet to establish that construction of a solar facility has begun for purposes of claiming the ITC. Note that this guidance applies to residential and commercial solar projects differently.

The 2020 extension of the ITC has provided market certainty for companies to develop long-term investments that drive competition and technological innovation, which in turn lowers energy costs for consumers.

Despite progress, solar energy still only represents 2.5% of energy production in the United States.

Moving forward, a tax policy that continues to provide stability and investment opportunity for solar energy should be a part of any national discussions about tax, infrastructure, or decarbonization.

Impact of the Solar ITC

The ITC has proven to be one of the most important federal policy mechanisms to incentivize clean energy in the United States. Solar deployment, at both the distributed and utility-scale levels, has grown rapidly across the country. The long-term stability of this federal policy has allowed businesses to continue driving down costs. The ITC is a clear policy success story – one that has resulted in a stronger and cleaner economy.

How Does the Solar Investment Tax Credit Work?

The Investment Tax Credit (ITC) is currently a 26 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business that installs, develops and/or finances the project claims the credit.

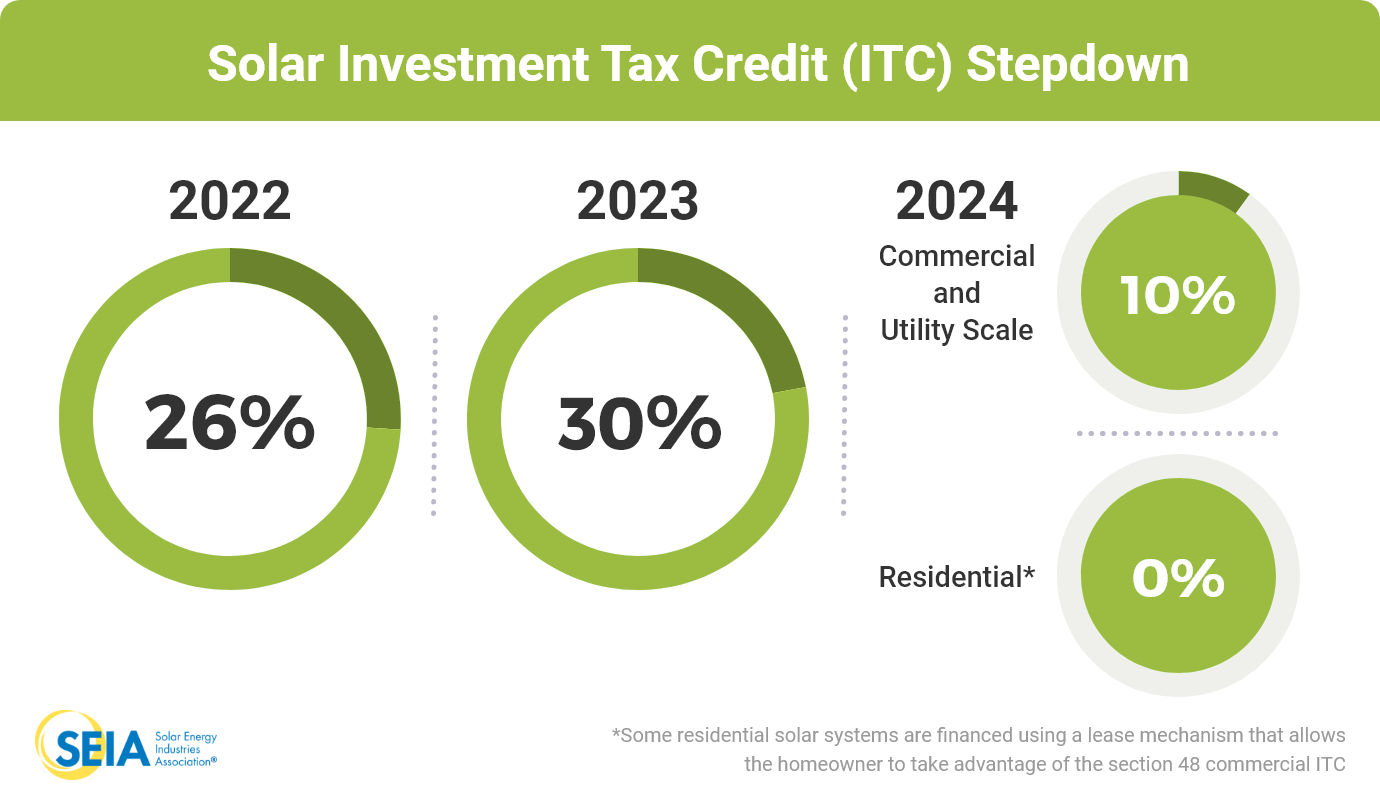

A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. Both the residential and commercial ITC are equal to 26 percent of the basis that is invested in eligible solar property. The ITC then steps down according to the following schedule:

- 26% percent for projects that begin construction in 2021 and 2022

- 22% percent for projects that begin construction in 2023

After 2023, the residential credit drops to zero while the commercial credit drops to a permanent 10 percent

Commercial and utility-scale projects which have commenced construction before December 31, 2023 may still qualify for the 26 or 22 percent ITC if they are placed in service before January 1, 2026. The IRS issued guidance (Notice 2018-59) on June 22, 2018 that explains the requirements that a taxpayer must meet to establish that construction of a qualified solar facility has begun for purposes of claiming the ITC.

To find out more information on the federal solar tax credit and calculate the credit amount per year based on household income, Solar-Estimate has a tax incentive calculator and additional detailed information.

Solar on New Residential Homes

If a homeowner buys a newly built home with solar and owns the system outright, the homeowner is eligible for the ITC the year that they move into the house. If the homeowners leases the solar system or purchases electricity from the system through a power purchase agreement (PPA), then the ITC is claimed by the company that leases the system or offers the PPA.

We recommended solar system ownership because ownership saves 3 times as much as leasing and increases a home’s value by up to $30,000. Leasing is simply replacing one utility with another and is subject to inevitable rate increases.

Here Are Some Questions to Consider...- Does your roof get exposure to the sun?

- Is there an area nearby that gets exposure to the sun?

- How much shade do you get on your roof?

- Can trees be pruned to allow more sunlight to the solar site?

A system’s size can vary based on the needs of the customer. You can choose to displace all of your electricity needs with solar power, or only a part. To gauge how large of a solar power system may be appropriate for your home.